What "Wall Street South" Really Means for Palm Beach Small Businesses (And How to Compete Without Wall Street Pricing)

- Maria Mor, CFE, MBA, PMP

- Nov 12, 2025

- 8 min read

5 Ways to Turn Corporate Migration Into Opportunity—Not a Threat

The Reality Check

BlackRock. Citadel. Goldman Sachs. Point72. Elliott Management.

These aren't just corporate names—they represent 483 asset managers controlling $18.2 trillion and thousands of high-paid employees now calling Palm Beach County home. Add 2,602 hedge funds and private equity firms, and you're looking at 19,077 business/finance companies operating in the county.

According to the Business Development Board of Palm Beach County, this area is now the #1 destination in Florida for New York relocations, with $7 billion in net income migration in one year alone.

For small businesses, the narrative goes like this:

"Big corporations are pricing us out. They pay higher salaries. They offer better benefits. They have unlimited marketing budgets. How are we supposed to compete?"

Here's the reality nobody's talking about: Wall Street South isn't just a threat—it's the biggest opportunity Palm Beach County small businesses have had in 20 years.

But only if you stop trying to compete on corporate terms and start leveraging what big companies can't replicate.

Here are 5 ways to turn "Wall Street South" from threat to opportunity.

What Wall Street South Actually Means

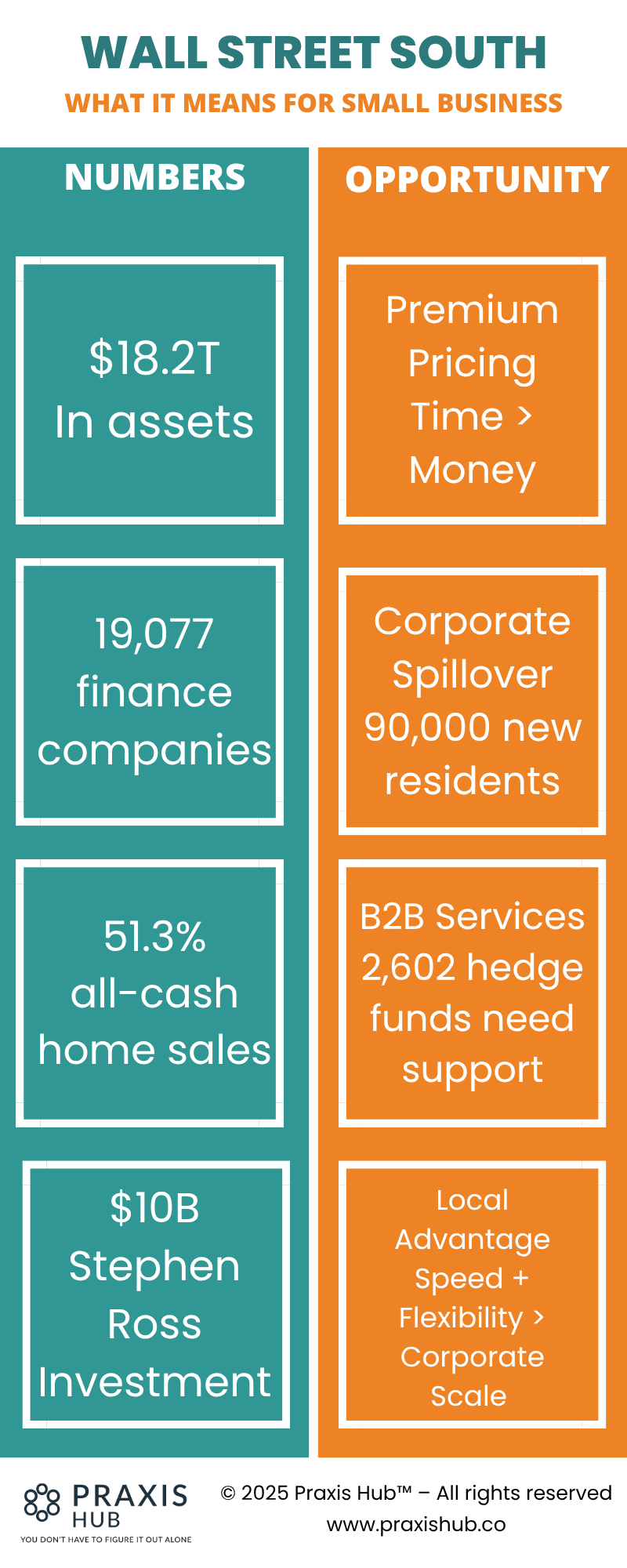

The Numbers (2025 Data):

According to the Business Development Board of Palm Beach County's latest data:

19,077 business/finance companies now operate in the county

2,602 hedge funds and private equity firms have established presence

483 asset managers representing $18.2 trillion in assets under management

#1 destination in Florida for New York relocations

$7 billion in net income migration in one year alone, led by incoming New York residents

Real Estate Impact (September 2025):

51.3% of home sales were all-cash (vs ~30% nationally)

$1M+ home sales up 20.9% year-over-year

Luxury market accelerating, not slowing

Infrastructure Investment: Billionaire Stephen Ross has committed $10 billion to reshape downtown West Palm Beach, creating more than 6 million square feet of Class

A office space, 1.4 million square feet of residential projects, 700,000 square feet of retail and dining, and several world-class hotels across 70 acres.

Major Corporate Players: Goldman Sachs, BlackRock, Citadel, Point72, Elliott Management Corporation—plus hundreds of smaller hedge funds, family offices, and private equity firms.

Translation: This isn't hype. It's $18.2 trillion in assets under management + $10 billion in infrastructure investment creating a completely new economic environment.

What This Means for Different Business Types:

Service Businesses (Cleaning, Landscaping, Home Services):

Opportunity: More high-value residential clients who value quality over price

Challenge: Wage pressure from corporate hiring

Strategy: Premium positioning for clients who can afford it

Retail & Hospitality:

Opportunity: Customers with higher discretionary income

Challenge: Rising commercial real estate costs

Strategy: Experience-based differentiation

Professional Services (Legal, Accounting, Consulting):

Opportunity: Corporate clients need local service providers

Challenge: Big firms have existing relationships

Strategy: Specialized niche expertise

B2B Services (IT, Marketing, Operations):

Opportunity: Growing businesses need support services

Challenge: Corporate procurement processes

Strategy: Flexibility + personal service that big firms can't match

The 5 Hidden Opportunities for Small Businesses

Opportunity #1: The "Corporate Spillover" Effect

What It Is:

When BlackRock moves 1,000 employees to West Palm Beach, those employees need: dry cleaning, car repair, restaurants for client dinners, gyms, pet services, home renovations, financial planning for their personal finances, tutoring for their kids.

Corporate employees are W-2 workers—they don't compete with you. They're potential customers.

The Opportunity:

According to the Business Development Board, Palm Beach County attracted $7 billion in net income migration in one year, led by New York relocations. These aren't retirees on fixed incomes—they're high-earning finance professionals with families who need services you already provide.

The Real Estate Signal: In September 2025, 51.3% of Palm Beach County home sales were all-cash—nearly double the national average. When buyers pay cash for $1M+ homes (up 20.9% year-over-year), they also pay cash for premium services. These are your ideal clients.

How to Capture It:

Position your business for the corporate customer:

Emphasize reliability and professionalism (they value their time)

Offer online booking/scheduling (they expect convenience)

Provide transparent pricing upfront (they don't want surprises)

Communicate clearly and promptly (they're used to corporate responsiveness)

Real-World Example Pattern:

Businesses serving corporate clients report that these customers prioritize quality and reliability over lowest price. They'll pay premium rates for services that save them time and deliver consistently.

Opportunity #2: Fill the "Gap Services" Big Companies Can't

What It Is:

Large corporations excel at scale and standardization. They struggle with customization, flexibility, and personal relationships.

What Big Companies Can't Do Well:

Custom solutions for unique problems

Fast turnaround on urgent needs

Personal relationships and local knowledge

Flexibility to adapt processes for each client

After-hours or weekend availability

The Opportunity:

You can say "yes" when big companies say "that's not our standard offering."

How to Capture It:

Build your business around what corporate providers can't replicate:

Speed: "We can start tomorrow" (they need 3 weeks to schedule)

Flexibility: "We'll customize it for your situation" (they only do standard packages)

Access: "Text me directly" (they route through call centers)

Local Knowledge: "I know Palm Beach County" (they're managed from New York)

Opportunity #3: Serve the "Support Ecosystem" Around Corporate Growth

What It Is:

When Citadel opens an office, they don't just hire traders. They need: office furniture, IT support, catering for meetings, corporate event planning, team building facilitators, executive coaching, wellness programs, local transportation services.

With 2,602 hedge funds and private equity firms now operating in Palm Beach County, the demand for business services has exploded.

The Opportunity:

Become a preferred vendor for the growing companies themselves—not just their employees. With 19,077 business/finance companies in the county, there's massive B2B opportunity for service providers who can meet corporate standards.

How to Capture It:

Position as a business services provider to corporate clients:

Professional brand presentation (corporate-level quality)

Reliable delivery (they can't afford vendor failures)

Scalable offerings (start small, grow with their needs)

Professional invoicing and payment terms (NET 30, purchase orders)

What Works:

"We work with [recognizable company names]" (social proof)

"We understand corporate procurement processes" (you speak their language)

"References available upon request" (builds trust)

Opportunity #4: The "Authenticity Premium"—What Money Can't Buy

What It Is:

Corporate relocators moved to Palm Beach County for quality of life, not just tax savings. They want authentic local experiences—not the same chain restaurants and services they left behind in New York or Chicago.

The Opportunity:

Local, authentic, and personal beats corporate and generic.

How to Capture It:

Lean into your local identity:

"Family-owned since [year]" (not a franchise)

"Palm Beach County native" (you know the community)

"We know your neighbors" (local relationships matter)

"Support local" positioning (community connection)

What Corporate Money Can't Replicate:

Personal relationship with the owner

Multi-generational family business story

Deep local knowledge and connections

Community involvement and reputation

Opportunity #5: The "Anti-Corporate" Niche

What It Is:

Not everyone moving to Palm Beach County wants the corporate experience. Many are escaping corporate culture and actively seek small, independent, human-scale businesses.

The Opportunity:

Position as the antidote to corporate sterility.

How to Capture It:

Market what makes you different from corporate providers:

"No call centers—talk to real people"

"We remember your name and preferences"

"Decisions made locally, not in a distant headquarters"

"Flexible policies, not rigid corporate rules"

The Message:

"We're small on purpose. That's our advantage."

How to Position Your Business in the New Economy

Strategic Positioning Framework:

Don't compete on: Price, scale, benefits packages, marketing budget

Do compete on: Speed, flexibility, personal relationships, local knowledge, customization

Pricing Strategy for the Wall Street South Era:

Old Mindset: "I need to keep prices low to compete"New Reality: Corporate clients and high-income professionals value time over money

Strategic Pricing:

Charge premium rates for premium service

Bundle convenience (online booking, fast turnaround) into pricing

Offer tiered pricing (standard vs. priority/expedited service)

Don't apologize for your rates—confidently explain your value

The Test: If you're not losing 20-30% of leads because you're "too expensive," you're probably underpriced.

Marketing Message Shifts:

Old Message: "We're affordable and experienced"New Message: "We're reliable, responsive, and we know Palm Beach County"

What to Emphasize:

Years in business (stability)

Local presence (not managed remotely)

Direct owner involvement (not layers of bureaucracy)

Client testimonials (social proof)

Fast response time (we answer calls, not voicemail trees)

FAQ: Competing with Corporate Giants

How can I compete with corporate salaries and benefits?

You can't—and you shouldn't try. Instead, compete on culture, flexibility, and ownership. Refer back to Week 2's strategies: clear processes, meaningful work, and commute solutions often matter more than an extra $1-2/hour. Also, not every corporate relocator wants to work for a corporation—some specifically seek small business environments for better work-life balance and direct impact.

Should I raise my prices now that there are more high-income residents?

If you're delivering premium value, yes. But price increases must match service quality improvements. Don't just charge more—deliver more. Focus on reliability, professionalism, and convenience. High-income clients will pay premium rates, but they expect premium service. Start with 10-15% increases for new clients while maintaining current rates for existing customers during transition period.

Do I need to change my business to serve corporate clients?

Not necessarily. You might adjust how you present and deliver services (more professional communication, online scheduling, clearer pricing), but your core business likely doesn't need to change. Think of it as "corporate-friendly" rather than "corporate-focused." Many small businesses successfully serve both individual and corporate clients with the same services, just different packaging.

What if I can't afford to upgrade my brand to look "corporate"?

You don't need expensive branding to serve high-income clients. You need: professional communication (prompt responses, clear emails), reliable delivery (do what you say you'll do), transparent pricing (no surprises), and good online reviews. A simple, clean website beats a fancy but outdated one. Focus on operational excellence before visual polish.

Should I actively market to corporate relocators?

Depends on your business type. Service businesses (home services, personal services) can target corporate employees through local digital marketing (Google Ads for "West Palm Beach [service]," neighborhood-specific Facebook ads). B2B services should focus on LinkedIn presence and local business networking (Chamber events, industry associations). Retail/hospitality benefits more from location and word-of-mouth than active targeting.

How do I find out which companies are hiring locally?

The Business Development Board of Palm Beach County (bdb.org) publishes reports on corporate relocations and expansions. LinkedIn shows job postings by location. Local business journals (South Florida Business Journal) cover major hiring announcements. Join local business groups where corporate employees network. But remember: you're not recruiting their employees—you're identifying which companies' employees might need your services.

What if "Wall Street South" pricing me out of commercial real estate or talent?

This is a real challenge. For real estate: consider locations slightly outside the highest-demand areas (Lake Worth, Royal Palm Beach vs. downtown West Palm). For talent: focus on the strategies from Week 2 (systems, culture, flexibility) and Week 3 (eliminate inefficiencies to afford higher wages). If your business model can't absorb wage increases through efficiency gains or price increases, it's a signal that the business model needs adjustment for the current market.

The Bottom Line

"Wall Street South" is here. It's not going away.

You have two choices:

Compete on corporate terms (salaries, benefits, marketing budgets) and lose

Compete on small business strengths (speed, flexibility, relationships, local knowledge) and win

The businesses thriving in Palm Beach County right now aren't the ones fighting against corporate migration—they're the ones leveraging it. More high-income residents means more demand for quality services. More corporate offices means more opportunities for business services. More growth means more opportunity.

But only if you position correctly.

Here's what to do this week:

Audit your positioning: Are you competing on price or value?

Identify one "Wall Street South" opportunity from the 5 above that fits your business

Adjust your messaging to emphasize what big companies can't replicate

Test premium pricing with new clients (10-15% increase)

Track results for 30 days

The companies that master this positioning over the next 12 months will own their market for the next decade.

Sources

Business Development Board of Palm Beach County - Latest Data

Business Development Board of Palm Beach County - Wall Street South Migration

Business Development Board of Palm Beach County - Major Businesses

MIAMI REALTORS® - Palm Beach County All-Cash Market Data (October 2025)

Newswire - New Yorkers Relocating in Record Numbers (November 2025)

Palm Beach County Chamber of Commerce - Business Resources

Florida Atlantic University College of Business - South Florida Economic Report

Comments